If you’re managing a small or medium sized business, sick pay rules for part-time staff can be confusing and stressful. Mistakes don’t just cause headaches; they can lead to fines or legal trouble.

In the UK, laws protect part-time workers from unfair treatment compared to full-time workers.

The main reason you’re reading this is to find out whether part-time workers are eligible for sick pay.

Spoiler alert – they are!

And the upcoming updates Employment Rights Bill in 2026, mean sick pay will be available from day one.

We’re here to explain how it all works and take a look at just how much statutory sick pay (SSP) part-time workers can get.

A quick note to introduce ourselves: We're Timetastic, a Staff Holiday Planner used by thousands of teams and small businesses from pretty much every country in the world!

What is statutory sick pay

Statutory sick pay (SSP) is the minimum amount employers must pay to workers who can’t come in because they’re ill. It's a safety net for staff who would otherwise be without pay. It helps cover costs until they’re back on their feet.

SSP is the same for both full- and part-time employees. There’s no pro rata, no rounding down, and no reducing it along with contractual hours. Everyone’s eligible for the same minimum pay.

What counts as a part-time worker?

There’s no official definition of a part-time worker, so the UK government simply puts it as ‘someone who works fewer hours than a full-time worker’. Vague, we know, but it gets the point across.

Overtime doesn't affect the definition either. If they’re contracted for less than full-time hours, they’re a part-time worker.

Statutory sick pay entitlement for part-time staff

Major changes are coming with the ERB, and we expect to see them land in 2026. To help get you prepared, here's exactly what you need to know.

Current SSP rules (2025):

- £118.75 a week SSP for up to 28 weeks

- Only paid after the first three working days of sickness

- SSP for up to 28 weeks

- Must earn £125+ per week to be eligible

Upcoming SSP changes from 2026:

- Payable from the first day of sickness

- No lower earnings limit

- People earning below the standard SSP (£118.75/week) will receive 80% of their weekly earnings

You should always check your employee contract and company policies to find out more information. You might have a scheme in place which pays more than SSP in some situations, known as Occupational Sick Pay (OSP).

There are some exemptions on eligibility, so things like maternity pay and ESA (Employment and Support Allowance) can get in the way. When in doubt, head on over to the UK government’s website to check the full list of exemptions and rules.

What other benefits do part-time workers get?

Part-time workers should be treated the same as full-timers for all your other perks, things like:

- Sick pay

- Maternity leave, paternity leave, adoption leave etc.

- Pension contributions

- Holiday entitlement

- Training opportunities

- Performance bonuses

- Opportunities for promotions, transfers, career breaks, and redundancy

You'd normally apply these proportionally, according to how many hours they work each week.

So, if someone works four days a week and everyone else works five, the norm would be for them to get 80% of the full-time benefits.

Keeping track of sick leave

It’s always a good idea to keep track of sick leave. It means you can effectively plan for a smooth transition when your employees come back to work. Employee absence management systems help take the pressure off, and it means you don’t have to track everything via spreadsheet.

And, fortunately, we’ve got just the tool for you.

Timetastic: here to make sick leave simple

Categorise absences by type

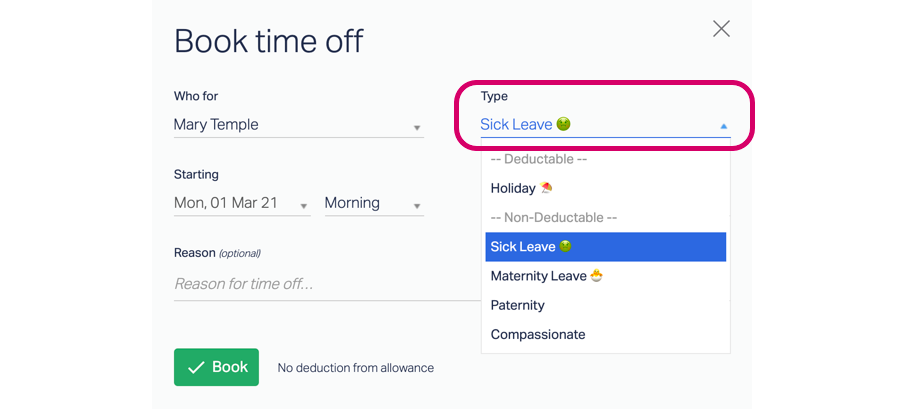

Most types of absence management software will let you differentiate between types of absences – like holiday, maternity leave, or illness.

The same is true for Timetastic!

The simplest way to keep track of sick leave is using the ‘Leave Type’ button, which then lets you see nice and clearly how long someone’s been off because they’re sick. Both employer and employee can access it, so either party can log the absence.

What’s more, the leave type is automatically split into ‘deductible’ and ‘non-deductible’, so you don’t have to worry about sick leave being taken from overall holiday allowance.

If you want to see this in action here's a direct link to create a free 30 day trial of Timetastic. There's no commitment, and it'll only take a few minutes.

View a tally of employees’ sick days

Once you’ve recorded the sick leave in the calendar’s booking system, you’ll be able to see a running total of all sick days taken for each employee!

The amount is given in hours, as you can see in the image below. So, in this example, the employee’s taken 35 hours of sick leave – which is four and a bit days off (if the employee normally works an eight-hour shift).

See the days on the calendar

You can see on our swanky colour-coded calendar a visual representation of how many days an employee has taken off ill.

Here you can see that Mary has taken a couple of days off sick each month. (Get well soon, Mary!)

The download option

And finally, if you want a deep dive into your sick leave stats, you can always download everything straight into Excel. From there, feel free to filter and sort to your heart’s content.

Just head to ‘SETTINGS’ 🡪 ‘REPORTING’ for the Excel download options.

There for all your calendar needs

Whether you’re calculating holiday and sick pay for part-time workers, booking off your own sick days, or just want to get an overview of any bugs going around the office, Timetastic's here to help.

We’re here to support both full- and part-time workers in any industry, in any country. If you’d like to try Timetastic out for yourself, don’t hesitate to get in touch with our amazing team, or try out our 30-day FREE trial – no credit card needed, no strings attached.

So, you look after your health, and we’ll look after the rest!

Want to learn more about SSP? https://www.gov.uk/statutory-sick-pay